Have you ever stood behind someone in line at the convenience store and watched them pay hard-earned money for a lottery ticket? Or walked through a busy casino, with people at the machines literally giving their money to the “house” all in the name of a little “fun?” Or what about watching someone inhale their future retirement through the ashes of a nasty smoking habit?

When I see these things, it gets me thinking about what it actually costs me to spend money on “frivolous” things. I’m not immune, of course. For me, it’s not usually gambling or cigarettes, it’s usually fast food, because I am too busy to pack a lunch that day. Or sometimes I’m just dropping a few dollars on a snack that I don’t really need, just to have something to munch on.

I’m not saying these things don’t bring a little bit of happiness in the moment that we buy them, but at what cost? So, being the finance nerd that I am, I pulled up a calculator and got to work to find out.

We All Only Have So Much Time

First things first. We all only have some much time. I’m sure you’ve probably heard that before, but have you really broken it down and looked at how little it really is?

Twenty-nine thousand and two hundred.

That’s about how many days most of us will have on this earth, based on an 80-year lifespan. The first sixty-five hundred or so will be spent in mandatory education, while the last eighteen hundred or so (or, approximately five years) will probably be hampered by the problems of old age. Now add in the approximately one-third of our lives that we will spend asleep, and the other one-third that we spend at work, and precious little time is left to enjoy. Using these simple assumptions, I came up with only about 8,000 days worth of time in the average lifespan that is actual free time an adult can choose to spend how he or she wishes. And, of course, that doesn’t include time spent on chores, caring for children or family, and other important duties.

So only about a quarter of our short lives are our own to control, at best? Time is short!

What is Your Time Worth?

If you’re paid by the hour, this is obviously a pretty straightforward calculation. And, those paid on salary can simply convert their wage into an hourly number without too much trouble. This is the amount of money that we willingly trade those precious few hours of our lives for. When I look at it like that, it changes my perspective. If I saved those precious few dollars each week that end up going to mindless purchases, how many more days of freedom could I buy before old age sets in?

Working Twenty-Nine Hours for a Pair of Jeans?

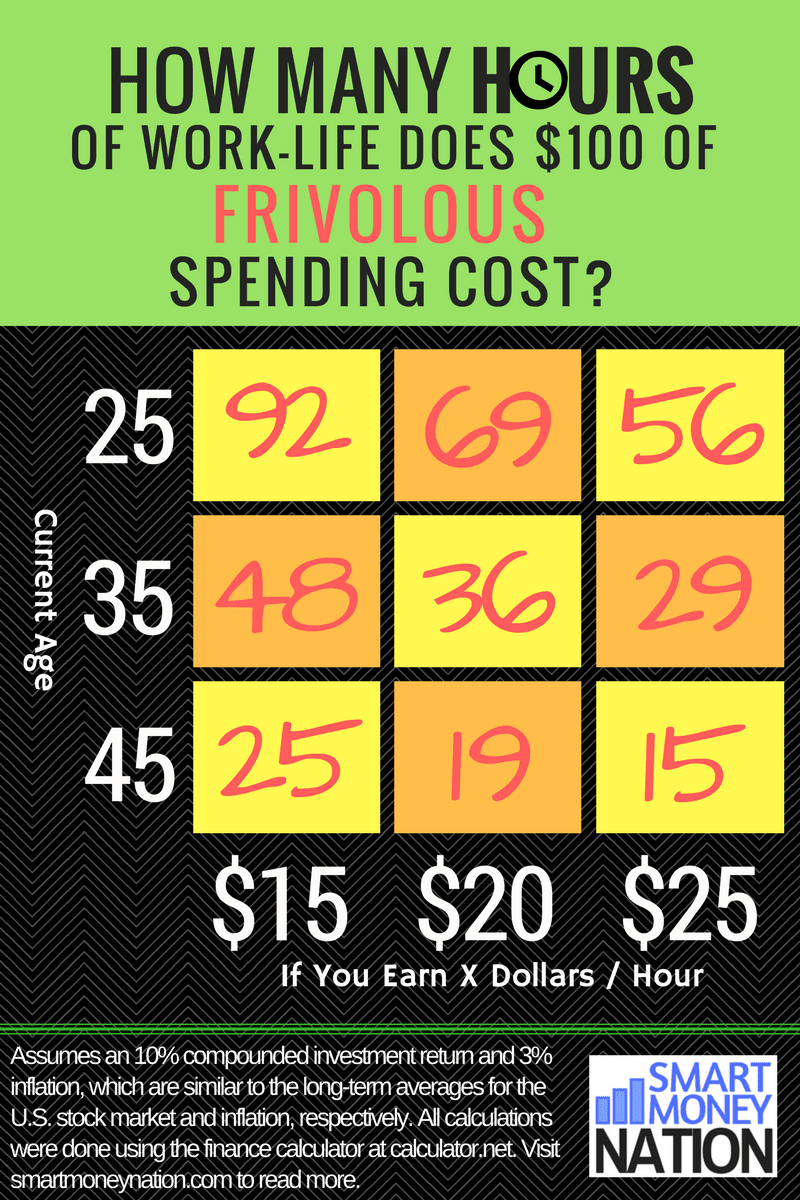

Here’s where we have to do a little math, but it’s not as complex as you might think. Applying some reasonable assumptions about long-term rates of return and inflation ,* and a 30-year compounding

,* and a 30-year compounding

period, I get a ratio of $71.89 for every $10 spent today and not invested. (You don’t even need a financial calculator for this, just use a free site like calculator.net.)

So, let’s say you want a new pair of jeans that you don’t really need, and they cost $100. That’s $718.90 of retirement nest egg down the drain, in today’s dollars (e.g. after accounting for inflation). If I make $25/hour, that’s about twenty-nine hours of work that I just exchanged for a pair of jeans. Or to put it another way, if I had saved that $100 instead (again, assuming the rates of return and inflation below,)* I would be financially independent 29 work hours earlier that I would otherwise. (Almost a whole work week!)

Now, sometimes you need to buy a pair of jeans. I’m not trying to beat anyone up here; that’s not my point. In fact, I just bought a new pair of jeans, and don’t feel guilty at all–I needed them. But the point is that by breaking the cost of something down into hours of your life, it’s easy to put into perspective the trade-off you make from purchasing unnecessary things, rather than saving.

The Younger You Are, The More Expensive Your Time

One of the key variables in this little formula is the compounding period, or the number of years from your current age until retirement. For someone who is younger than I am, things start to get really interesting. If we assume a forty year compounding period, all of the sudden the cost of $100 spent is $1,387.40, not $718.90.

In addition, we might want to assume a lower hourly rate, because obviously the younger you are the less you earn, generally speaking. So if we assume this person makes $15/hour, instead of my arbitrary example rate of $25/hour, that’s ninety-two precious hours exchanged for a $100 piece of cloth that will probably go out of style in a few years.

Ninety-two hours?! That’s over two full work weeks!

Conclusion

When we waste money, we waste our life, because that money could be invested and thereby allow us to reach financial independence a little more quickly. And while most of us know this, at least intellectually, I find that it’s helpful to actually think in terms of hours of our lives lost instead of just dollars. Hopefully, looking at it from that perspective will be as helpful for others as it has been for me. Every time I have the temptation to buy something that I really don’t need, I use this little formula to ask myself, is it really worth that much of my life? (To find your formula, just use the chart above to find the age and income most applicable for your situation.)

It is actually possible to retire early, and it’s not as hard as you might think. But only if you get start early and save as much as you can.

How about you? Will you find this helpful? Comment below and let me know.

*Assumes an 10% compounded investment return and 3% inflation. For comparison, the long-term return for the U.S. stock market is about 10% from 1926 until today, and the long term inflation rate over that period is about 3% on average. Also, it’s important to realize that, for simplicity, I’ve assumed that the money at retirement is just spent on living expenses, when in reality most of it would still be invested and working for you. My calculations were done using the finance calculator at calculator.net.