Budgeting, meet the 21st century. Now you can go from a “money mess” to a “money master” in less than an hour, all with the help of our friends (and future overlord-masters), the computer. While I’ve talked about “lazy” budgeting techniques before (for example, the anti-budget approach), and I think that they can work for some people, I find that the more I actively budget my money, the more often I meet my savings goals each month. And when I do blow past my budget, at least I do it purposefully and with a reason. (And yes, the occasional spontaneous travel adventure does constitute a valid “reason.”) 😉

So, what’s the most convenient way to start budgeting consistently and effectively? Easy. You train a computer to do the tedious, boring work for you. And while there are several good online budgeting apps on the market, today I’m going to review the first cloud-based system and one of the most popular options available … Mint.com.

Here are the top six features of Mint.com that I’ll discuss:

- Why it’s FREE!

- Expense Tracking and Categorization

- Budgeting

- Notifications

- Credit Score Updates

- Net Worth Tracking

My Experience with Mint.com

When I first heard about Mint.com years ago, I’ll be honest, I was super excited to sign up. What’s not to love about a computer doing all the boring budgeting work that we all hate doing? That’s the kind of stuff that computers were made for, right?

So, I used Mint for quite a while, and loved it. Then, somehow I was introduced to the security concerns inherent in how it (and other automated budgeting systems) works. Without doing a lot of research, these concerns began to gnaw at me, and I deleted my account on Mint. From there, I went back to the “anti-budget approach” for a while, but then I started this blog and decided I should revisit Mint to write this review. But, first I had to confront the security concerns that I had about the product. After all, to use Mint.com to its full capacity, you have to give it all the passwords to your bank, credit card, and other important financial accounts. Talk about feeling naked!

If you share these concerns, I encourage you to read my in-depth look into the security of Mint.com here. In the end, after doing my research, I’ve decided to keep using it as my main budgeting tool, at least for now. For me, if you take certain precautions, the rewards vastly outweigh the risks.

Mint.com is Free to Use

So, why should you try Mint.com for budgeting? Well, for starters, it’s FREE.

(It’s not the only free budgeting app out there. Personal Capital is another similar option you might want to check out. I plan to write a review on it next…)

Why is it free? I believe it’s always important to understand the “why” behind a “freemium” business model. In Mint’s case, its business model is to “recommend” products to you based on your spending habits. So the strategy is like broadcast television — the content is provided free with the caveat that you have to let them pitch you things.

Expense Tracking and Categorization

One of the advantages of Mint is that it’s super easy to get started using. You just connect up your accounts by punching in the login credentials for each site — Capital One, Bank of America, Navient, etc. — and the system goes to work. (Again, worried about security? Check out my in-depth review of Mint’s security here.) Once it starts downloading your transactions, Mint will often try to categorize your transactions automatically based on other users’ activity. It’s not always correct, but it’s right often enough to get you started in the right direction. And, the beautiful thing is that you can train the system to categorize things correctly in the future.

Teaching Mint to Automate Your Budget

As I mentioned, to really get the most out of Mint, you have to train it. What I mean by this is that it will attempt to categorize your transactions as best it can. Spend 15 minutes and go thru those one by one to fix any errors and tell it how to categorize future transactions correctly. This will save you tons of time in the future.

While we’re talking about categorization, I don’t recommend getting too detailed with it. Stick to the big picture categories and avoid getting too elaborate, especially at first. The idea is only to divide the data when it makes sense. Don’t get too detailed where it won’t help you down the road; you don’t want to lose the big picture by getting lost in the details.

At the end of the day, what matters is the total amount you spend, not the individual categories. More importantly, what matters is how much you save relative to your income. That’s one of the biggest factors that will determine your long-term success. (For more on this, check out “How to Do A Cash-flow Summary” and “How to Retire Early and Never Pay Taxes.”)

Use Notifications to Keep You on Top of Your Money

Normally, I’m the first person to opt-out of any service (no matter how much I love it) from sending me notifications to my email inbox. I’ve even been known to get an email from a salesperson that I don’t particularly want to hear from, and reply with a big fat “UNSUBSCRIBE” in the subject line, even if there is no unsubscribe option available. But when it comes to Mint, I turn the email heat up until I can’t stand it any longer.

The beauty of having a robot checking on your finances is that it can let you know when wacky things happen. What if a hacker gets in and starts monkeying around? Mint can let you know. Or when I make an unusual purchase, I know that Mint will send me a reminder to my inbox the next day, which just might make me reconsider whether or not said item is in the budget.

Other than a few extra emails, there is no downside.

Budgeting is More than Just Tracking Your Purchases

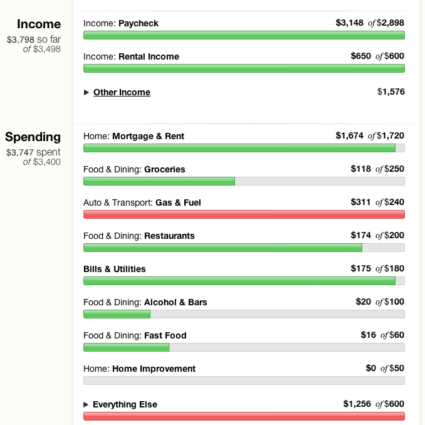

So far, all I’ve talked about is how Mint.com can help you track your spending. That feature is great, but it’s technically not the same thing as budgeting. Budgeting takes the process one step further and asks you to plan out, ahead of time, where you are going to spend your money. In the budgeting section of Mint, you can set up limits for categories each month.

For example, let’s say that you usually spend $500/month eating out. You can then set a budget of that amount, and ask Mint to tell you when you get close to hitting that number. In addition, you can set your budgets to roll-over any leftover amounts to the next month, or just start each month at zero. That allows you a lot of flexibility to design the system to your exact needs.

I will offer you one word of caution. Mint.com will not budget for categories that you don’t set a budget for. So, in the budgeting section of Mint, it will simply list “everything else” at the bottom, if you haven’t set specific budgets for those categories. For this reason, it’s easy for the budgeting section of Mint to become useless if you don’t monitor and reorganize your budgets regularly.

Credit Score Tracking

Another feature that I love about Mint.com is that it now provides credit scores! Now, there are lots of other free ways to get your credit score, such as Credit Karma and others, but I love the convenience of having it right there on my Mint.com dashboard. Bear in mind that the score is provided from Experian, which is just one of the three major credit bureaus, but they are usually identical, or nearly so. Still, it’s always a good idea to request your score annually from the free, government-sanctioned website, annualcreditreport.com.

Net Worth Tracking

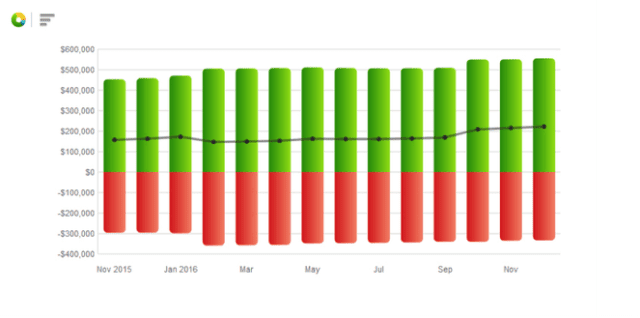

While this isn’t technically part of budgeting, I do think monitoring your net worth is very important part. In fact, at the financial planning firm where I work, we start every meeting with a review of the client’s net worth. It’s a big-picture snapshot of where you are financially at a given point in time.

sample of Net Worth tracking in Mint.com

What is your “net worth?” It’s simply your assets added together, minus your debts. The result of that simple calculation is your “net worth.” For example, if you have $500 in a checking account, but you owe $1000 on a credit card, your net worth is -$500.

Mint.com takes this to another level, and provides a neat graph that tracks your net worth over time. So, if you put all your accounts in the system, it can track your true net worth as it grows, which is a great way to keep you accountable towards your goals.

Conclusion

On the whole, Mint.com is a decent combination of powerful features and ease-of-use. However, even with it’s ability to automatize your budgeting, you still have to spend a little time each month spot-checking, organizing, and monitoring it. Even after using it for almost a year now, I still find that I need about 30 minutes each month to keep the data in top shape. However, once you get used to it, Mint.com can help you keep on top of your finances as conveniently as possible.

That said, there are some areas of Mint that I don’t find very helpful. The billpay feature can’t actually directly be used to pay bills, unlike the billpay offerings that come free in many bank accounts. Also, I don’t use the investment tracking features at all. Frankly, these are useless at best, and misleading at worst, so I recommend finding a better app for this purpose. But as simple and easy-to-use budgeting and expense-tracking software, Mint.com is a solid option in my book.