Dividend-paying stocks offer a unique benefit that sets them apart from other types of stocks – the opportunity for an almost immediate return on your investment through regular dividend payments. The allure of dividend investing lies in its potential to offer both capital appreciation (growth of your invested capital) and a consistent income stream in the form of dividends.

So, what exactly is dividend investing, and why might you consider adopting it as a part of your investment strategy? Is it a strategy suitable for all investors, or is it primarily tailored for individuals seeking income from their investments, particularly retirees? Furthermore, what historical performance does dividend investing have, and is there a reasonable expectation for its success in the future? Finally, how can you easily embark on a journey into dividend investing?

What is a Dividend?

Before delving deeper, let’s start with the basics. What is a dividend? In essence, a dividend represents a portion of a company’s profits that is distributed to its investors, often on a quarterly basis. To illustrate, consider the following fictional scenario:

Imagine Lucy, an ambitious entrepreneur, establishes a lemonade stand that captures widespread attention due to its exceptional product. As demand soars, Lucy expands her operations, creating a vast network of lemonade stands across the country. With her business thriving, Lucy achieves billionaire status and her face is plastered across all the business magazines in the country. However, even with all her fame and wealth, Lucy faces a small, practical problem – while her wealth is considerable on paper, it’s all tied up in her company’s stock without a direct income source. To put it bluntly, Lucy is “cash poor.”

To address this, Lucy’s company allocates a portion of its profits as a dividend payment to Lucy, its owner. This dividend provides Lucy with a consistent income stream, while the remaining profits are reinvested into the business to fuel its growth. After all, both Lucy and her management team want the whole world to get to taste her amazing lemony liquid over time.

What is Dividend Investing?

Dividend investing centers around selecting stocks based on their dividend payouts. However, the focus is not solely on the monetary value of the dividend; instead, investors often calculate the dividend yield of a stock. The dividend yield informs investors how much income can be expected for every $100 invested in the stock, enabling comparisons across various investment options like bonds, CDs, real estate, and more.

To compute the dividend yield, one multiplies the dividend payment per share by four (for quarterly payments) and then divides the result by the stock’s share price. For example, if Lucy’s Lemonade trades at $100 per share with a quarterly dividend of $1.25, the annual income from dividends is estimated at $5.00, resulting in a dividend yield of 5%.

In dividend investing, emphasis is placed on generating income (i.e., dividend yield) when selecting stocks. While some investors prioritize yield as a key factor, others consider it alongside various other criteria. Regardless, the overarching goal for income-focused investors is to optimize the income stream from their stock portfolio over time.

Does Dividend Investing Work?

The historical performance of dividend investing, when contrasted with broader stock market indices such as the S&P 500, displays mixed results. Different strategies within dividend investing have exhibited varying degrees of success. Some strategies have outperformed the market over time, while others have closely mirrored market returns. A few approaches have even lagged behind the broader market.

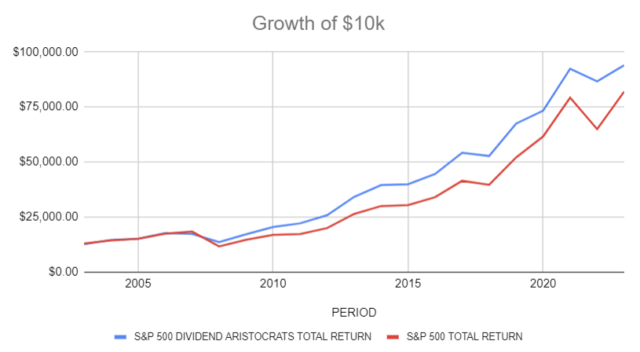

However, it may be instructive to examine one particular strategy in more detail. The S&P 500 Dividend Aristocrats index tracks companies that have consistently increased (not just paid) their dividends for at least 25 consecutive years, and some for much longer periods (40+ in many cases.) This index strategy has yielded superior total returns (including reinvested dividends) as the S&P 500 (see chart below). However, during market downturns, the dividend aristocrats index has exhibited significantly more resilience, likely due to the financial stability associated with companies maintaining a long dividend history.

It’s important to note that this performance was achieved simply by tracking companies based on their dividend history without in-depth fundamental analysis. Therefore, it stands to reason that an experienced management team picking stocks based on a more comprehensive analysis could achieve even more impressive results.

DATA SOURCES: *PERIODS PRIOR TO THE LAUNCH OF THE S&P 500 DIVIDEND ARISTOCRATS INDEX (MAY 2, 2005) USE HYPOTHETICAL BACKTESTED PERFORMANCE PROVIDED BY S&P GLOBAL. DATA PRIOR TO 2012 WAS PROVIDED BY YARDENI RESEARCH.

Bear in mind that this outperformance is achieved simply by tracking the S&P 500 Dividend Aristocrats Index, which doesn’t include a robust analysis of the companies that are selected. Basically, Standard and Poors (“S&P”) simply selects about 40 companies that are already part of the S&P 500, and that “have increased dividend payments each year for at least 25 years, and meet certain market capitalization and liquidity requirements.”

Could a dividend investing strategy with a basis in deep fundamental analysis fare even better?

What Are the Tax Implications of Dividend Investing?

Taxes play a pivotal role in investment strategies, as unnecessary tax payments can erode returns. While qualified dividend rates range from 0% to 20%, similar to long-term capital gains rates, it’s worth noting that capital gains offer more flexibility than dividends in terms of timing. Dividend income, determined by company management, lacks control over timing and amount, unlike capital gains, which can be managed to some extent through careful investment decisions.

However, the predictability of dividends often outweighs the flexibility of capital gains. Dividend payments are generally more assured, especially for financially robust companies with a history of stable payouts. Additionally, investments held within tax-deferred retirement accounts alleviate tax concerns.

How to Find Good Dividend-Paying Stocks

Numerous investors seek out high dividend yields to generate income from their portfolios, often to cover expenses. However, basing investment decisions solely on dividends without conducting thorough research into the underlying companies can prove to be a critical mistake.

Consider the case of General Electric (GE). In 2017, the stock traded around $30 and offered a dividend yield of approximately 4%. Yet, subsequent financial challenges led to a sharp decline, with the stock recently hovering around $8 per share, a 73% decline! Furthermore, in 2018, GE was compelled to drastically reduce its dividend to just one penny per share. Instances like these are more common than some income investors realize, underscoring the absence of guarantees associated with dividends. Even stocks boasting impressive dividend yields or a long dividend history can falter in the face of financial adversity.

This phenomenon is particularly relevant in an environment of low interest rates. As interest-bearing options like CDs and bonds offer minimal returns, income-focused investors might be tempted to turn to dividend-paying stocks for higher income. Nevertheless, it’s crucial to remember that stocks inherently carry more risk compared to bonds and CDs, lacking the protective features of fixed-income investments.

Ultimately, regardless of the dividend’s value, bondholders are prioritized in case of bankruptcy, leaving stockholders in a secondary position. Consequently, conducting comprehensive research into the financial health of a company before investing is paramount.

Several key factors deserve attention in the realm of dividend investing, although a comprehensive exploration is beyond the scope here. Among those factors are the following:

- Prioritize Financially Sound Companies: Dividend-paying companies must first establish the viability of their business models through consistent profits. This will often help investors steer clear of speculative sectors, opting for firms with stable financial foundations. However, investors should still inspect the balance sheet of even the longest-paying dividend companies. Sometimes, a high yield is used by management to disguise financial weakness.

- Seek Consistent Dividend Growth: The ability to not only maintain steady dividend payments but also increase them over time may indicate financial discipline and stability. The commitment to quarterly payouts compels management to allocate resources to projects with a confident return on capital.

- Don’t Just Focus on Yield: While dividend yield is important, it shouldn’t be the sole focus. A company’s profits can be allocated to dividends, stock buybacks, or reinvesting in the business. Stocks with ample free cash flow that still choose to distribute dividends might be indicating a lack of attractive reinvestment opportunities. This could potentially render them susceptible to market share loss over time.

- Consider the Pay-Out Ratio: The pay-out ratio measures how much of a company’s profits are paid out in dividends. Among blue chips, AT&T (T) pays one of the highest dividend yields in the market today, at around 6%. That represents a payout ratio of 58%, which means approximately 58% of company profits get paid out to investors, leaving only about 40% to be reinvested into growing the business. Whether that’s enough to continue to grow the business and fight off the competition is for the investor to decide.

- Look to Buy at a Reasonable Valuation: Assessing the company’s valuation is pivotal. Like any form of investment, stock selection entails not only assessing future potential but also the price paid. Valuation metrics such as the P/E ratio, P/S ratio, and book value can provide insights into a company’s valuation relative to its performance.

How to Get Started Easily

Because of its many benefits, dividend investing is an attractive strategy for many investors. However, achieving success in dividend investing necessitates more than just identifying high-yield stocks. Thorough analysis is vital to selecting companies with strong yields, solid financials, and promising business prospects.

For individuals seeking to execute this strategy without dedicating extensive time to analyzing company financials, there are viable options such as mutual funds, exchange-traded funds (ETFs), and separately managed accounts. In such cases, seeking guidance from a financial advisor can aid in selecting the most suitable option aligned with individual circumstances. To discuss dividend investing further or to get a second opinion on your portfolio, don’t hesitate to reach out to us at Symphony Wealth!

________

Important Notes*

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value weighted index with each stock’s weight in the index proportionate to its market value. Indices are unmanaged and investors cannot invest directly in an index.

Mutual Funds and Exchange Traded Funds (ETF’s) are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from the Fund Company or your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

Smart Money Nation does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstance.

The results of forward-testing does not represent the results of actual trading using client assets and should not be considered indicative of the skill of the adviser. Forward-testing (aka paper trading) fails to address the broad market’s impact on individual securities and generally does not account for cost like slippage, commissions or fees. Forward-testing often includes “formfitting” which is the ability to select ideal entry and exit points.

This article mentions various investments and investing strategies; however, the mere mention of an investment, investment platform, security, or investment method does not constitute investment advice. Please read SMN’s disclaimers for more details.