It’s a simple calculation to take the long-term average return of stocks (roughly 10-12%/year since 1926 in the U.S.) and project that into the future. Doing so often can make you feel better about your finances, even if maybe you’re a little behind on your savings goals.

(Shh… don’t worry; your secret’s safe with me.)

For example, using the simple rule of 72, a 10% average annual return doubles your money every 7 years or so, meaning a 35-year-old with a $500,000 portfolio can expect to reach close to six million before his 61st birthday.

Yeah, if only it were that simple.

Stock Market Returns are Lumpy

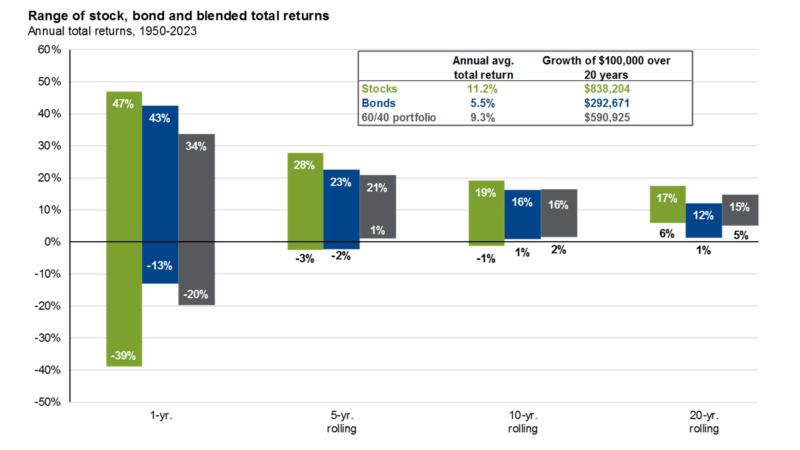

Unfortunately, the stock market is a fickle thing. It reacts quickly, often violently, to the news of the day, and can sometimes go years (even a decade or more) without making any progress at all. In fact, a close inspection of historical returns shows that hitting that exact 10% average return number is actually somewhat rare. It’s much more likely to be significantly above or below that amount.

Sources: JP Morgan Guide to the Markets, Bloomberg, Factset, Federal Researve, Robert Shiller, Strategas/Ibbotson.

That’s one reason why trying to time the market usually doesn’t work.

The Dangers of Market Timing

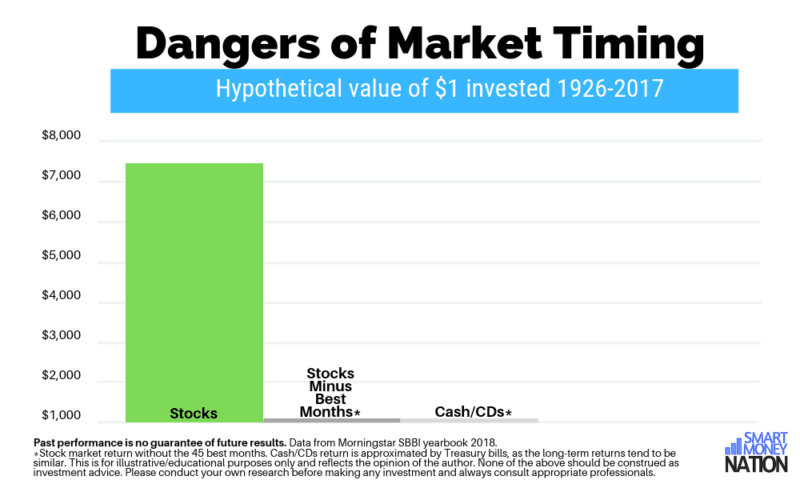

Investors who attempt to time the market run the risk of missing periods of exceptional returns. This practice may have a negative effect on a sound investment strategy. The chart below illustrates the risk of attempting to time the stock market since 1926.

A hypothetical $1 investment in stocks invested at the beginning of 1926 grew to $7,353 by year-end 2017. However, that same $1 investment would have grown to only $27.73 had it missed the best 45 months of stock returns. One dollar invested in savings accounts, CDs, or money markets (approximated by treasury bills) resulted in an ending wealth value of only $20.79. Therefore, an unsuccessful market timer, missing the 45 best months of stock returns, would have received a return equivalent to that of just investing in cash equivalents.

Most investors are familiar with the success stories of those who “called the top of the market,” but you never hear of those who got it wrong. Their faces never show up on CNBC or Bloomberg. For every George Soros and Michael Burry, there are countless others who lost it all (or just never made any money) by trying to play the same game.

The dirty little secret is that it is very difficult to time the market consistently. I would go even further–it’s impossible to do consistently over time.

Think about it; at the end of the day, the market is made up of people, people making decisions that may or may not be 100% rational. If I can’t predict my own emotions on a daily basis, how can I expect to predict the emotions of millions of other investors?

If I can't predict my own emotions on a daily basis, how can I expect to predict the emotions of millions of other investors? Click To TweetHave an Investment Plan Instead

So if timing the market doesn’t work, and stock market returns are unpredictable, what’s a better strategy? The strategy is simply to have a plan and stick to it. For most investors, that means hiring a professional to help you design a investment plan that makes sense for your situation.

However, just having a plan isn’t enough. Your advisor should be able to explain it to you in words you understand and then implement it for you on an ongoing basis. Investing isn’t a one-time event, so even the best plan has to be adapted to market conditions as things change.

A good advisor can take a complicated strategy and break it down into simple terms so that any investor can feel confident in the plan. Ideally, you want an advisor that could draw it on the back of a napkin. That ability to go from intricate and complex to simple and concise probably means that they really understand it. It also may indicate confidence in their mastery of the strategy and willingness to answer questions without hiding behind jargon and pseudo-complexity.

It also may show that they aren’t just regurgitating a pre-packaged strategy from a 3rd party research or money management firm.

At the end of the day, you need someone who can “hold your hand” and explain what’s going on when the market gets volatile. We as humans constantly fight the same tendencies–chasing returns when times are good and panicking when times are bad. This causes us to make the exact wrong moves at exactly the wrong times. Instead of buying low and selling high, we end up buying high and selling low. A good advisor can provide an unbiased and experienced perspective to keep you on the plan through this periods.

Ultimately, we are often our own worst enemies, and even experienced professional investors sometimes panic at the wrong times.