Last year I was fortunate enough to knock a huge goal off my bucket list — travel the world. I never took time after college to travel, and as my mid-thirties were beginning to get away from me, I felt like it was now or never. So, I packed a bag, made a rough itinerary, and set off on a great adventure.

But before boarding the airplane, I had to sort out a few things financially, such as how to get cash in foreign countries without paying foreign transaction fees, currency exchange fees, and ATM fees. In the course of planning, I learned that the best, simplest, cheapest way to get money in a foreign country is by having the right ATM card.

In fact, there are now a handful of banks that even offer 100% FREE ATM withdrawals worldwide.

This is very important for international travel because, even in 2018, there are many places in the world that won’t take your credit card, and they’ll look at you rather strangely if you try to pay with Apple Pay, Venmo, or the Cash app.

Yes, cash is still king in many parts of the world, which means you’ll need a way to get cash without lugging around tons of greenbacks and exposing yourself to theft, loss, and just getting ripped off. Indeed, you’ll probably want to keep a “low profile” in many places in the world, because flashing large wads of cash can make you an instant target for criminals and pickpockets.

You also can’t assume that everyone will want to accept your US dollars. Perhaps that used to be true in the past, but today the average taxi driver or roadside vendor doesn’t typically want greenbacks. They want pesos, euros, baht, or whatever other currency the locals use.

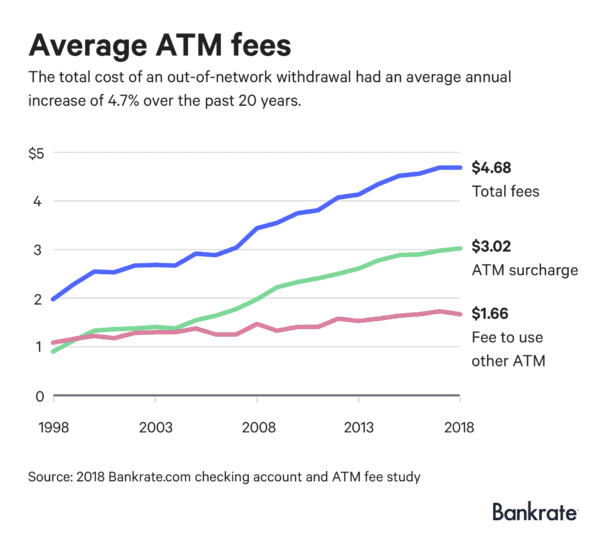

So if you carry a lot of dollars, you’ll need to be constantly exchanging them for the local currency, and my experience has always been that using currency exchange services is extremely expensive. (Many times the “spread” on currency exchanges is over 20%!) You’re far better off using an ATM machine for both cash withdrawals and currency conversions. However, ATM fees continue to rise.

With the rise of electronic payment apps and services, ATM machines are seeing less and less usage even as their costs of operation stay the same. The result of this trend is that ATM fees have hit a new record high for the fourteenth straight year, as banks attempt to grow their profit margins even in a low interest rate environment.  So, if you’re planning to travel, what’s the solution to all of this? An ATM debit card with FREE ATM withdrawals anywhere in the world.

So, if you’re planning to travel, what’s the solution to all of this? An ATM debit card with FREE ATM withdrawals anywhere in the world.

Why Some Banks Offer Free ATM Withdrawals Worldwide

Many online banks offer free ATM withdrawals because they want and need to raise capital but don’t have a large network of branch locations to offer to customers. Instead, their customers can go to any bank’s ATM machine, insert their card, agree to the fee, and withdrawal funds. Then, at the end of the month, the bank reimburses them for any ATM charges assessed by the other bank.

That said, many of these online banks limit the amount of free ATM withdrawals you can make each month. Honestly, that would be absolutely fine with me normally, because in everyday life I only use an ATM a few times each month.

However, on my trip I was going to eleven countries in just ten weeks, so I would be hitting the ATM machine quite frequently. Additionally, many online U.S. banks offer ATM fee reimbursements domestically, but won’t offer free withdrawals outside the United States. However, for this trip I needed a bank with unlimited ATM withdrawals anywhere in the world. Thankfully, there is a small group of banks that offer exactly that.

Top Banks with Free ATM Withdrawals Internationally

Charles Schwab Bank

This is the checking account I used for my trip and the one I most highly recommend. Since I already had investment accounts at Schwab, a rep there mentioned the checking account several years ago, and I have loved it ever since.

There are no limits to how many free ATM withdrawals I can make each month, both domestically and internationally, so I can use almost any bank’s ATM machine in the world to make these withdrawals — for FREE! In fact, I have used ATMs in Mexico, Colombia, Singapore, Sri Lanka, Czech Republic, and many more, all without any ATM fees or foreign transaction fees.

And even though Schwab has very few physical locations, I actually use them as my main bank for all my checking and savings account needs. Their iPhone app allows me to deposit checks remotely, and they offer a full-featured bill-pay service as well. There are no account minimums or monthly account fees either.

What’s more, the ATM card also doubles as a VISA debit card, which you can also use at any store anywhere in the world (that takes VISA) without foreign transaction fees! (Personally I prefer to use a credit card with no foreign transaction fees for purchases outside the U.S., but the debit card is a nice thing to have around just in case.)

The bottom line is that whether you use Schwab bank for your everyday banking or just for foreign travel, you won’t be disappointed. Last, I should also mention that Schwab offers a comprehensive list of international phone numbers, just in case you need to speak to a bank representative when you’re traveling abroad.

Needham Bank

It took a lot of searching to find Needham Bank, but apparently they’ve been around since 1892. This small, Massachusetts community bank also offers unlimited ATM withdrawals anywhere in the world. With a Needham Bank checking account, you can make worrying about ATM fees a thing of the past, along with monthly fees, minimum balance requirements, and foreign transaction fees.

How does it work? When you open a checking account, you get a ATM/debit Mastercard along with it. Then, you can use that card as a debit card wherever Mastercard is accepted, or use it at any ATM machine worldwide for free. I was initially concerned about using the Mastercard network over VISA’s (which is what the Schwab debit card uses), but according to Nerdwallet there is very little difference between the the two networks internationally.

So, if you prefer a community bank with actual branch locations, and happen to live near a Needham Bank branch, you might prefer them over Schwab. Other than that, I can’t find much of a difference between the two.

First Republic Bank

While First Republic Bank perhaps is not a household name, it should be on your list if free ATM withdrawals anywhere in the world is important to you. Why? Because this small California bank offers all the perks that any traveler would need:

-

- they rebate all ATM fees, both foreign and domestic

- no foreign transaction fees

- online billpay

- free electronic transfers

- extended phone support hours (until 9pm PST all days except Sunday, and even then they’re open until 5pm PST)

There are a few small differences from Schwab bank, however. Although First Republic does pay interest (although at miniscule 0.005%), in return they require an average daily balance of at least $3,500. If it drops below that, you get hit with a $25 per month fee–ouch! You’ll want to make sure to keep your account well-stocked if First Republic is your pick.

Other Options for Banks with Generous ATM Withdrawal Policies

The three banks listed above are the most generous in reimbursing ATM fees for their customers. However, if you prefer more options, here are a couple more banks that offer refunds on ATM withdrawals albeit with some limitations.

Fidelity Investments

Fidelity is primarily an online brokerage firm (similar to Charles Schwab) offering investment accounts for stocks, bonds, and mutual funds. However, they too have jumped into the banking world, and without physical locations have also decided to rebate ATM fees to attract bank customers. Therefore, I expected to find that their fee reimbursements would be as generous as Schwab Bank’s. And, they are for the most part, but there are a couple of important differences to watch out for.

While Fidelity reimburses all ATM fees charged by foreign banks worldwide, they still charge a 1% foreign transaction fee. So, while a $4 ATM fee on a $100 ATM withdrawal is 4%, a 1% foreign transaction fee on a $400 ATM withdrawal gets you to the same number. If you’re traveling a lot, those costs could add up over time.

CitiBank Gold Checking

CitiBank is known for being particularly friendly to international travelers. With branch locations in over 20 countries, you’re usually not far away from a branch representative. In addition, they offer many of the same benefits as the other recommended banks above, including ATM fee reimbursements worldwide. However, the Citibank checking account requires a minimum balance of $200,000 to waive the monthly account fee. Until that minimum comes down, I can’t recommend them as highly as the others.

Conclusion

Traveling outside the United States requires a plan to get access to your money in the most convenient and cost-effective way possible. While most banks can accommodate foreign travel, very few make it easy and cost effective, especially when it comes to ATM transaction fees. Thankfully, there are a handful of banks that reimburse ATM fees no matter where you are in the world. Of the three I found, Charles Schwab Bank comes with the highest recommendation. After them, Needham Bank and First Republic Bank are solid alternatives as well. Do you have any experience with these banks? Or maybe a story about accessing money while traveling? Leave them in the comments section below!

Note: Considerable effort was made to accurately represent the policies of the banks mentioned, however I cannot guarantee accuracy or that policies will not change in the future. Please, do you own research before trusting your money with any bank.