We don’t have to be smarter than the rest. We have to be more disciplined than the rest. –Warren Buffett

One of the things that most people don’t understand about growing wealth the right way–the slow and steady way–is that it’s more about just doing the small things consistently over time.

You don’t have to invent the next iPhone, all you have to do is simply avoid shooting yourself in the foot.

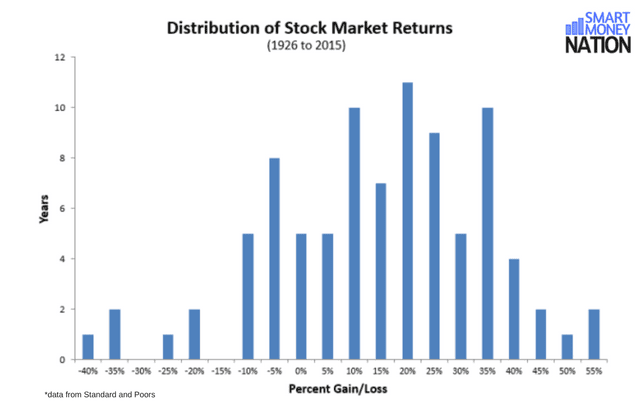

In that vein, today I want to talk about three essential keys to growing your wealth over the long-term by using one of the best investments ever created — the stock market. Take a second and review my last post if you missed it — What Returns Can an Investor Expect in the Stock Market? — and think about how amazing it is that stocks grew by 10-11% per year over the last 90 years. Returns like that can turn almost any average middle-class American into a wealthy millionaire if applied to decades of consistent investing.

However, that last article also pointed out that to get those returns, you had to stomach quite a bit of volatility over time. As Buffett also has said, “unless you can watch your stock holding decline by 50% without becoming panic-stricken, you should not be in the stock market.”

But consistency is easier said than done, so today I want to discuss three additional keys that are absolutely essential to helping you capture as much return (with as little risk) as possible over your lifetime as an investor.

Diversification

Any individual company can go bankrupt at any time. The classic example of this is Enron, a company praised for its ambitious projects and that was called “America’s Most Innovative Company” by Fortune magazine six years in a row. At its height, it had a total market value of over $60 billion and was the darling of Wall Street. But just one year later, it filed for bankruptcy.

You might think that a savvy investor should have seen that collapse coming. But in Enron’s case, that was almost impossible. Financial analysts, professionals assigned to study Enron as part of their full-time jobs, and who have decades of experience and extensive training, only started to get suspicious about Enron’s opaque accounting practices at the very end. If their jobs and billions of dollars were on the line, and they still couldn’t see the collapse coming, why would you or I?

This is why diversification is crucial to the average investor. While historical returns are more than enough to provide a comfortable retirement for most people (assuming they save a decent amount consistently and start at a young enough age), having to start over again because you lost everything in a single stock can be devastating.

A Long-Term Horizon

As I discussed in the last post, investing in the stock market, even in a diversified portfolio, inherently involves volatility. It’s just part of the game.

The chart I showed there bears repeating:

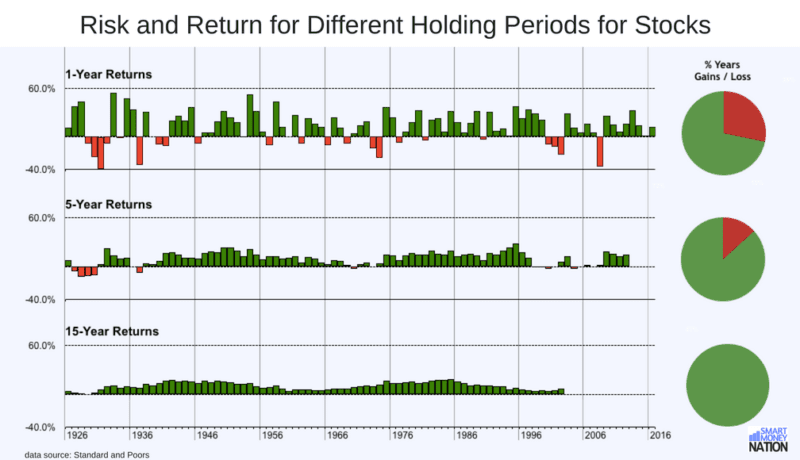

However, did you know that over any 15-year time period in the market, a diversified investor never lost money?

The data in the next chart shows the returns of large U.S. companies since 1926, drawing on data from Standard and Poors. As you can see, on a year-to-year basis there is quite a bit of volatility when investing in stocks, even with a diversified portfolio. And while about two-thirds of the time the market went up, there is still a significant amount of red (i.e. losses).

However, a look at the five-year chart shows red only about 15% of the time, and in the 15-year chart, there is not one period of loss!

So one takeaway we can make is that stock investing, which can be extremely volatile over the short-term, is actually not as risky over extended periods.

Calm Under Pressure

Now while having a diversified portfolio and a long-term perspective are crucial, all your good work can be undone in a moment, if you try to predict when to jump in and out of the stock market. The old adage of “buy low, and sell high” is easy to say, but often hard to do in real life, and I have seen over and over again the temptation for almost all people to “time the market.”

Smart and successful people are often worse at this, because their whole lives they have been successful by taking action on their instincts. However, this is an instinct that is totally counter to how a rational investor should behave.

Consider a few things:

- The “market” is just made up of other people, just like you and me. As William Feather once famously said, “one of the funny things about the stock market is that every time one person buys, another sells, and both think they are astute.”

- Very often, the driving force behind short-term market movements is simply emotional–fear or greed.

- Since we know emotions often drive the market, how can they be predicted? I can’t even predict what my own feelings are going to be when I wake up tomorrow morning. How am I going to predict the collect emotional state of investors across the globe?

- Geopolitical facts which will affect the market (a terrorist attack, for example) are most of the time unknowable. We know this because if they were knowable, the market, which is constantly and rabidly seeking any sort of informational edge, would already know and have priced in that knowledge into the underlying price of securities. Which is to say, the market would have already gone down.

- Since 1-4 above are true, it is not possible to “time the market.” And, when you consider that just missing out on just 13 of the best months in the last twenty years reduced your return by 66%,* it can potentially do real damage to your long-term goals.

Conclusion

Stock investing doesn’t have to be the big, scary mystery that so many people make it out to be. And while some strategies are certainly better than others, there are some essential truths that remain true over time. Staying diversified, having a long-term perspective, and not trying to time the market, are three essentials to a healthy and growing portfolio.

*based on a study by Morningstar, $1 invested in stocks in 1996 grew to $4.82 by the end of 2015. However, if during that same period you missed out on the best 13 months, your investment grew to just $1.64.

Definitely another awesome piece.

My wife and I have been in the market since the early ’90’s. We’ve applied all these principles, ever since we started. How did we know to do so?

We were lucky, in that we went with our gut feelings. Nobody taught us about investing. Heck, my Father In Law consulted with me on what to do with his retirement buy out. :-O

We didn’t always do as well as we have since 2013, when we moved away from our Sales Person adviser to Fisher Investments, using Fidelity as our vehicle for our larger portfolios.

Since March of 2013, our Fidelity portfolio has grown 32%, as of today’s numbers. This is all without any additional deposits, and with our drawing $2000.00 a month for about a year now.

We live on my Teachers’ Retirement payments and let the investment draw cover the house payment and provide fun money.

We don’t trade, but simply let Fisher do the work. So far, we are VERY pleased.

Not to brag, just to back up what you’re saying about investing in the market.

Diversification

Long Term Horizon

Calm Under Pressure.

Go into stock market investing with these guidelines constantly in mind and folks should do well.

Keep up the great work! I’ll be looking for more good reads.

Thanks again, Shin! I 100% agree, just consistently applying the basics in investing goes a long way towards success. Glad you enjoyed the post, and thanks for sharing it to help get the word out. 🙂